IRS Roundup: Key Actions by NTEU

Below is the status of significant national grievances and negotiations pending with IRS. NTEU will continue to hold the agency accountable in defense of your hard-won collective bargaining agreement (CBA):

February 28, 2025 Return to Office Directive

Telework and Remote Work

On March 5, 2025, NTEU filed a national grievance and national institutional grievance regarding IRS’s February 28 “Plan to Return to the Workplace.” The grievance alleges violations of Article 50 (Telework) and the Federal labor statute. Among the actions that NTEU demands IRS take include reinstatement of all telework and remote work agreements. A grievance meeting was held on March 28. IRS failed to issue a written response to the grievance. NTEU invoked arbitration on May 16, 2025.

STATUS: Arbitration hearing is scheduled for December 9, 2025.

Inadequate Workstations and Seat Assignments

On March 27, 2025, NTEU filed a national grievance when IRS failed to have adequate workstations and unilaterally assigned workstations to employees required to return to the office per IRS’s February 28 “Plan to Return to the Workplace.” The grievance alleges violations of Article 11 (Facilities and Services), Article 15 (Reassignments/Realignments and Voluntary Relocations) and the Federal labor statute. Among the actions that NTEU demands IRS take include returning employees to their telework/remote work agreements until there are adequate workstations and employees have the opportunity to select them in compliance with the contract. A grievance meeting was held on June 3.

STATUS: Awaiting IRS’s response to the grievance.

Reasonable Accommodations

On March 21, 2025, NTEU filed a national grievance regarding IRS’s failure to grant proper interim accommodations for reasonable accommodation requests and for improperly requesting employee medical information per IRS’s February 28 “Plan to Return to the Workplace.” The grievance alleges violations of Article 55 (Reasonable Accommodation), the Rehabilitation Act of 1973 and the Federal labor statute. Among the actions that NTEU demands IRS take include granting interim accommodations and compensatory damages. The agency did not schedule a step meeting or provide a response. NTEU invoked arbitration on June 3, 2025.

STATUS: The next step is to schedule a hearing date with the arbitrator.

Temporary Hardship

On March 20, 2025, NTEU filed a national grievance based on the Agency's failure to grant temporary hardship telework requests (amended grievance here). The agency did not schedule a step meeting or provide a response. NTEU invoked arbitration on June 3, 2025.

STATUS: The next step is to schedule a hearing date with the arbitrator.

Reduction-in-Force (RIF)

On April 7, 2025, NTEU filed an institutional national grievance regarding the IRS’s notice to all employees on April 4 that it was commencing a RIF. The grievance alleges violations of Article 19 (Reduction-in-Force), Article 47 (Mid-Term Bargaining) and the Federal labor statute. Among the actions that NTEU demands IRS take include rescission of the RIF notices. On May 7, the IRS briefed NTEU, which included bargaining team members Chapter 10 President Lorie McCann (IRS Chicago), Chapter 24 President Brian Norton (IRS Michigan), Chapter 52 President Simon Garcia (IRS South Texas), and Chapter 66 President Shannon Ellis (IRS Kansas City Service Center). NTEU submitted initial proposals which the IRS has stayed based on the current Exclusions Executive Order litigation.

On May 16, NTEU amended the grievance when IRS committed additional violations including but not limited to the IRS's failure to respond to NTEU's information requests, sending RIF notices to Taxpayer Experience Office (TXO); and proposing a RIF in the Offices of Privacy, Government Liaison and Disclosure (PGLD), Procurement, and Communications and Liaison (C&L). The IRS has failed to respond or hold a grievance meeting on the amended grievance.

STATUS: NTEU will invoke arbitration on the amended grievance.

Termination of Certain Alternative Work Schedules

On April 14, 2025, NTEU filed a national grievance when IRS terminated the 4/10 compressed work schedule. On April 24, NTEU filed an amended national institutional grievance regarding IRS’s termination of 5-4/9, 4/10 and Maxiflex work schedules. The grievance alleges a violation of Article 23 (Hours of Work), Article 47 (Mid-Term Bargaining) and the Federal labor statute. Among the actions that NTEU demands IRS take include the reinstatement of those schedules.

STATUS: We are in the process of scheduling a step meeting with the agency.

Mass Terminations of Probationary and Trial Employees

On March 12, 2025, NTEU filed an institutional grievance when IRS sent termination notices to at least 6,500 probationary and trial employees on February 20. The grievance alleges violations of Article 19 (Reduction-in-Force), Article 47 (Mid-Term Bargaining), the RIF statute and regulations, the Federal labor statute and the U.S. Constitution. Among the actions that NTEU demands IRS take include following the CBA. IRS refused to hold a grievance meeting and failed to issue a response to the grievance. NTEU invoked arbitration on May 15, 2025.

STATUS: The next step is to obtain available hearing dates from the arbitrator.

Resignation Withdrawals

On May 22, 2025, NTEU filed a national grievance based on IRS denying numerous employee requests to withdraw their resignations. The grievance alleges violations of Article 5 (Employee Rights) and the Federal labor statute. Among the actions that NTEU demands IRS take include approving employee requests to rescind their resignations.

STATUS: NTEU will be amending the grievance to include employees who requested to rescind their signed DRP agreements and to withdraw their applications for VERA or While the grievance did not originally contemplate covering these claims, members and chapters provided evidence that allowed NTEU to craft arguments regarding why these employees may also be entitled to remedies.

Cancellation of Recruitment Incentives

On June 30, 2025, NTEU filed a national grievance regarding the IRS's recent unilateral cancellation of recruitment bonuses and incentives. The recruitment bonus practice had been established by the IRS after the passage of the Inflation Reduction Act of 2022. We allege that the IRS violated the contract and Federal labor statute by unilaterally terminating this practice without providing us with notice and the opportunity to bargain. Among the actions that NTEU demands IRS take include the reinstatement of the recruitment bonus practice and a make-whole remedy for those who were not provided a recruitment incentive after the agency's unilateral cancellation of the bonuses and incentives.

STATUS: NTEU is awaiting the IRS's availability to hold a grievance meeting.

LB&I, Pass Through Entities Leave Tracker System

In June 2025, NTEU learned that the IRS, Large Business & International (LB&I), Pass Through Entities (PTE) division has unilaterally implemented a new Leave Request Tracker (“LRT”) system which the IRS claims will streamline the leave request process. NTEU was not provided with any information on this system, and we did not agree to its implementation. NTEU has filed a national grievance alleging that the IRS violated Article 8, Union Rights, Article 23, Hours of Work, Article 32, Annual Leave, Article 34, Sick Leave, and Article 50, Telework, of the 2022 National Agreement (2022 NA) and the 2025 Addendum; the Single Entry Time Reporting (SETR) Memorandum of Understanding (MOU), and the law. To remedy the violations NTEU requested to cease and desist from violating the 2022 NA, 2025 Addendum and the law, maintain current leave request procedures, and make whole any employees impacted by the unilateral implementation of the LRT.

STATUS: NTEU is awaiting the IRS's availability to hold a grievance meeting.

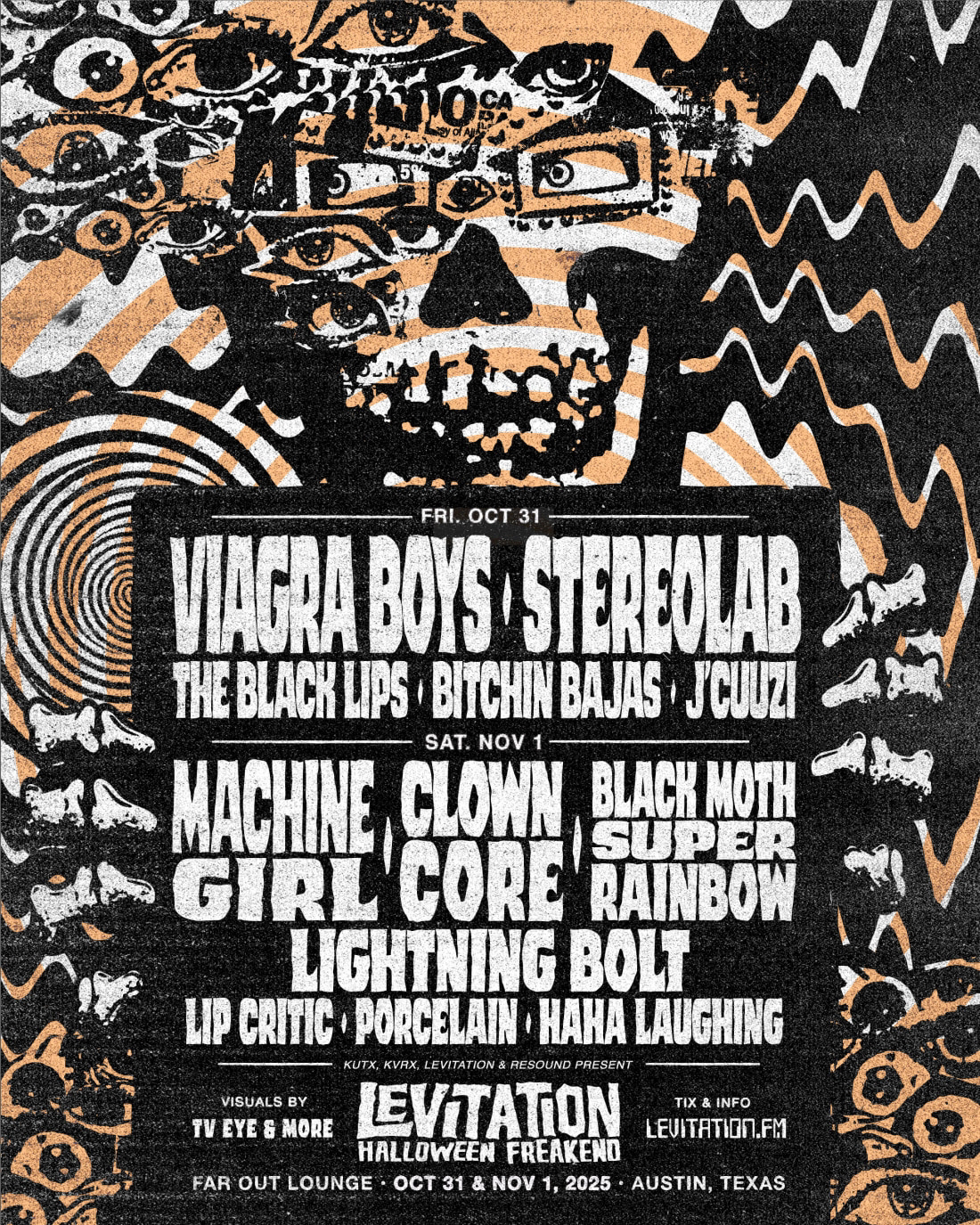

Austin-Area July Fourth Fun and You: A Guide

https://www.austinchronicle.com/arts/2025-07-04/austin-area-july-fourth-fun-and-you-a-guide/

The Epstein files

60 minutes: Australia

https://youtube.com/watch?v=Zeylckd2t0Y&si=Yz1BRqflkn0R8UIg

|

![Artstråda Magazine "We will Art your FACE OFF" [18+]](https://blogger.googleusercontent.com/img/a/AVvXsEjw3ZbJnLQoI9Oe4IeaRKDZkH_dkwD9LUdzJ6f-zGLoRrg-vsSRELBtCDL6Esoil1IJLBMVGqTwAhEN1yiXJmfIx2BwaOH67juunCQmleBM0_YMXWGjJRYSPkSIw8Q1L6fKaffkmuubaYnumKjRsyBT3NL8QPi6M-yXBq9WpmL_1583YLRZmy9obICx=s800)

Comments

Post a Comment